Budget 2021 is certainly historic. In responding to the unprecedented challenges of COVID-19, it is focused primarily on protecting jobs for the coming year, as well as providing significant increases in resources for public services to cope with additional demands.

There are few personal tax changes (i.e. income tax, USC and PRSI), as according to Minister for Finance, Paschal Donohue, “resources must be focused on saving jobs and on protecting our health”.

Of the nearly €18 billion Budget package:

- €8 ½ billion is for public services to address the challenges of Covid19

- €3.8 billion will be spent on supporting existing services across a range of departments, in particular the Department of Health;

- €3.4 billion will establish a Recovery Fund to stimulate demand and employment

- €1.6 billion increase next year on expenditure on core capital programmes

- €270 million on tax measures

Key takeaways

For a full written overview of the key takeaways, scroll down or click here.

“To-date, the total value of support measures amounts to €24½ billion. This is nearly eight times last year’s Budget plan. We have never experienced a challenge like this in modern times. I am today announcing a total budgetary package of over €17¾ billion, more than €17 billion of which relates to expenditure, and €270 million in taxation measures. This package is unprecedented in both size and scale in the history of the Irish State.

There will continue to be much uncertainty on many issues for the coming period. Our key objective here today is to ensure that economic policy does not compound the uncertainty, but helps to manage and mitigate it for individuals, for families and for businesses throughout the country.”

Paschal Donohoe, Minister for Finance, 13th October 2020

PERSONAL TAX

There has been no major changes to personal taxation on income in the budget.

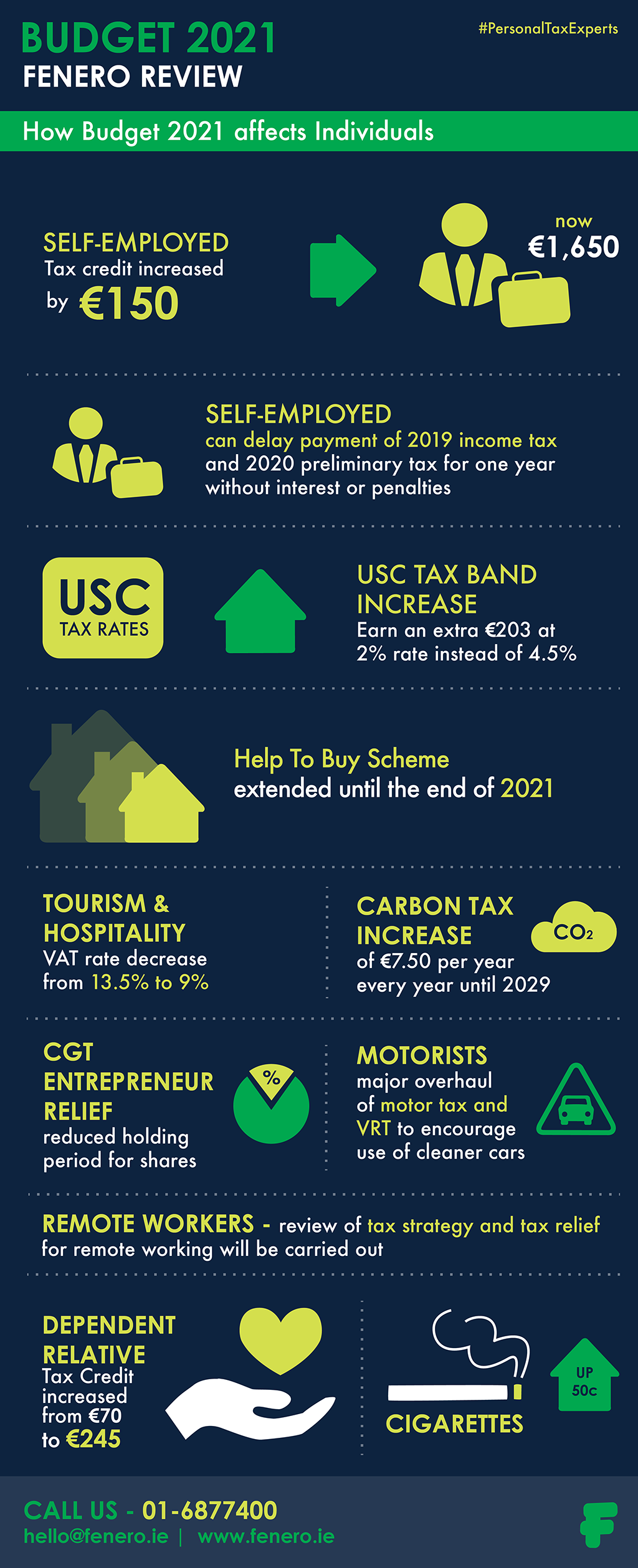

However, the 2% USC rate band will be increased slightly, allowing you to earn an additional €203 at the 2% rate before moving into the 4.5% rate.

Additionally, the Dependent Relative Tax Credit will increase from €70 to €245 to support families with caring responsibilities.

ENTREPRENEURIALISM & SELF EMPLOYED

Earned Income Tax Credit

Importantly for the self-employed, the earned income tax credit is increasing by €150 to €1,650 to finally bring it fully in line with that of the PAYE credit for employees.

Expansion of the Warehousing of Tax Liabilities

The tax debt warehousing scheme essentially is a scheme which allows individuals and businesses to delay paying their tax liabilities as a means of providing temporary financial and cash flow support.

The scheme will be expanded to further support:

- Individuals by including preliminary tax obligations for adversely affected self-assessed taxpayers and;

- Businesses by including repayments of Temporary Wage Subsidy Scheme owed by employers.

Entrepreneur Relief

A boost to CGT Entrepreneur Relief is being given by amending the holding requirement so that an individual that held at least 5% of the shares for a continuous period of any three years qualifies. All other qualifying criteria remain unchanged. This measure will come into effect 1 January 2021.

Corporation Tax

The corporation tax again will remain at 12.5%.

Employers PRSI

The weekly income threshold for the higher rate of employer’s PRSI will increase from €394 to €398 from 1 January 2021. This follows a recommendation of the Low Pay Commission to ensure that the increased hourly minimum wage of €10.10 to €10.20 does not lead to work disincentives for workers, in particular those seeking to work full-time.

Wage Subsidy Scheme

A new version of the Employment Wage Subsidy Scheme will be implemented after the current scheme ends next spring.

COVID Restrictions Support Scheme for businesses

A new scheme is being introduced for businesses who have closed due to Covid-19. It is effective from 13th October 2020 (Budget Day) and will run until the end of March 2021. The scheme will operate when Level 3 restrictions are in place and will cease when restrictions are lifted. If restrictions are extended, a subsequent further claim can be made. Businesses must demonstrate that turnover has been severely impacted by up to 80 per cent.

A maximum of €5,000 per week available as additional support under the scheme. The amount available will be based on average weekly turnover for 2019. The first payments will be made in the middle of November.

REMOTE & HOME WORKING

The Minister for Finance acknowledged the very significant increase in home and remote working during 2020 and the important role it has played, and will continue to play, in responding to the pandemic.

In today’s announcements, he highlighted again that the Programme for Government includes a commitment to develop a strategy for remote working and remote service delivery. An Inter-Departmental Group has already been set up to work on this.

We look forward to sharing a future article here on our Knowledge Hub when any new initiatives are announced.

In the meantime, you might find it useful to review our recent summary of current tax reliefs on expenses for contractors when working from home at: https://www.fenero.ie/knowledge/covid-19-working-from-home-what-expenses-can-i-claim/

HOMEOWNERS

The additional Help to Buy Scheme measures which were introduced on 23 July 2020 have been extended until the end of 2021. It provides for an increase in the amount that may be claimed up to a maximum of €30,000.

MOTORISTS

Carbon Tax

Carbon tax will be increased by €7.50 from €26 to €33.50 per tonne/CO2. This increase will be applied to auto fuels from 14th October 2020 and all other fuels from 1 May 2021.

In a win for the Green Party, further increases of €7.50 each year for the next ten years will also be brought into law as part of Budget 2021.

The €7.50 increase will mean a €1.51 rise in the cost of a 60 litre fill of diesel and €1.30 for a similar amount of petrol.

Vehicle Registration Tax (VRT) and Motor Tax

A major overhaul of VRT and motor tax is being undertaken to encourage the use of cleaner cars.

BIK on Electric Vehicles

The 0% BIK charge on qualifying electric vehicles remains the same.

If you are a contractor interested in purchasing a vehicle through your Limited Company, contact us for more information on the expert services and solutions we offer to contractors to help you minimise your tax liabilities and maximise your earnings.

INDIRECT TAXES

Efforts to discourage smokers continue, with excise duty on cigarettes rising again – up 50 cent on a packet of 20 cigarettes, with a pro rata increase from other tobacco products.

To support the badly hit hospitality sector, the VAT rate of 13.5% will decrease to 9% from 1 November 2020 until the end of 2021.The VAT rate on electronic publications is being reduced from 23% to 9%.

STAY INFORMED – WE’RE HERE TO HELP

For any initiatives where timelines are unclear at this time or further details are to follow from government in the coming days and weeks, be sure to follow Fenero on LinkedIn to be kept up to date. Just click on the “Follow” button to be kept up to date with relevant and important news.

Multi-Award Winning Tax Experts In All Things Contracting!

Fenero are multi-award winning friendly tax specialists and experts in all things contracting. We are straight-talking tax and financial experts, with a single-minded mission to deliver market leading customer experience; fast, friendly, informative service and great value fees.

Reasons why Contractors choose Fenero include:

- 24/7 Access to myFenero Contractor Portal

- Dedicated Account Manager

- Multiple money-back service level guarantees

- Great value fees

- Comprehensive insurance coverage

- Google Reviews rating 4.9/5

- Contractor Wellbeing Programme – free medical and counselling services and discounted health insurance plans

- Financial and Tax Planning Support

- Winners: 2019 Accountancy Practice of the Year

- Winners: 2019 Customer Experience Impact in Professional Services

- 11 years + experience

- Process €100m+ contractor payments annually

We are proud winners of the prestigious overall award of Accountancy Practice of the Year in the 2019 Irish Accountancy Awards and also the CX Impact in Professional Services Award in the 2019 Irish Customer Experience Impact Awards! So talk to the best in the industry for all the expert tax and financial advice you need to maximise the financial benefits of contracting!

For more information on getting started in contracting or to get a free illustrative calculation showing how much you can earn as a professional contractor, drop a line to the friendly, expert crew in our Solutions Team.