“We cannot hope to remain competitive if someone on a relatively low income and who decides to work a few hours overtime has nearly half that extra money taken in tax.”

Paschal Donohoe, Minister for Finance, 10th October 2017

Personal tax rates continue to be a hot topic of discussion in Ireland. We have a highly progressive income tax system in the context of global comparisons, but our higher tax rates kick in at a relatively low level of earnings.

This has a big impact on all Irish taxpayers but also impacts Ireland’s ability to attract new talent into the country, as these individuals weigh up the overall costs of a move to Ireland.

With existing skills shortages in some sectors and the opportunity of winning more foreign investment in the wake of Brexit, it is essential that Ireland focuses on offering a competitive personal tax regime for individuals.

A reduction in personal tax rates is however also very welcome for all Irish taxpayers, particularly those still suffering the impact of years of austerity.

How will individuals be affected by changes in Budget 2018?

Here are the key takeaways:

Personal Tax

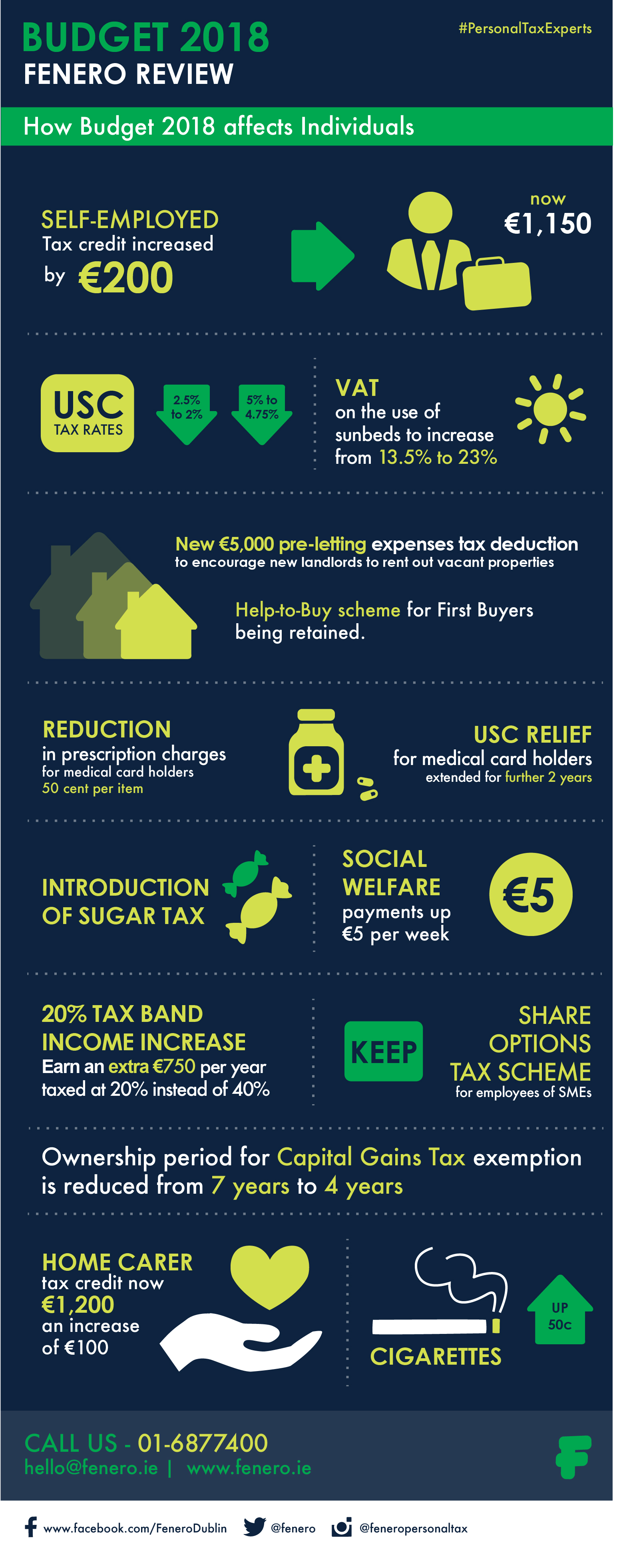

The threshold for the 20% tax rate band will be increased. You can now earn €750 more at the lower rate of tax before moving into the 40% tax rate band.

There will be reductions in two USC rates. The 5% rate will reduce to 4.75%. The 2.5% rate will reduce to 2%. Additionally, the 2% rate will not kick in until you earn €19,372 – this is an increase from the previous earning level of €18,772.

The Home Carer tax credit will increase by €100 to €1,200.

USC relief for medical card holders will be extended for a further 2 years. Medical card holders and individuals aged 70 and older, whose total income does not exceed €60,000 will pay a maximum USC rate of 2%.

Landlords

In a nod towards the housing crisis, a new tax relief is being introduced to encourage property owners to rent out vacant properties. A new tax deduction for up to €5,000 of pre-letting expenses will be available, subject to conditions. The tax relief will be clawed back if the property is withdrawn from the rental market within 4 years.

Entrepreneurialism, Self Employed & Capital Gains Tax

The Earned Income tax credit for the Self-Employed has been increased by €200 to bring it up to €1,150. This was expected, due to previous promises of moving the self-employed to closer tax parity with employees. The self-employed still pay a higher level of tax compared to employees, but the gap is closing.

The required ownership period for the Capital Gains Tax exemption on property is reduced from 7 years to 4 years.

A much discussed scheme which can be used by SMEs to offer employees with tax efficient share options has been announced. This scheme will provide SMEs with more tax efficient options to remunerate, reward and retain key employees. The scheme will be called KEEP, which stands for Key Employee Engagement Programme. However, as the Minister provided very little detail in his Budget speech, employers and employees will have to wait until the publication of Finance Bill to see all the details.

First Time Buyers

The Help-to-Buy scheme for First Buyers is being retained. There had been much debate earlier this year about the pros and cons of this scheme and whether it should be abolished. The government have opted to retain it. Check out our article on the Help-To-Buy scheme to see how you could avail of a possible €20,000 tax refund as a First Time Buyer.

Indirect taxes

VAT on the use of sunbeds is to increase from 13.5% to 23%. The rationale behind this isn’t to increase revenue for the government and instead is being implemented in line with the Government’s National Cancer Strategy to deter sunbed use.

Efforts to discourage smokers continue, with excise duty on cigarettes rising again – up 50 cent on a packet of 20 cigarettes.

A sugar tax is being introduced from 1 April 2018. The tax will be on sugar sweetened drinks based on their level of sugar content.