Budget 2026 was delivered against a backdrop of global uncertainty and persistent inflation. With an overall package of €9.4 billion, the Government has opted for a steady, responsible approach rather than headline giveaways.

It focuses on higher capital investment, housing, and targeted public services. Gone are the once-off cost-of-living and energy credits of recent Budgets. Instead, measures this year are more modest and longer-term.

At a glance

Of the €9.4 billion package:

- €8.1 billion relates to additional public spending

- €1.3 billion relates to tax measures

Below we’ve summarised the key takeaways that may affect you.

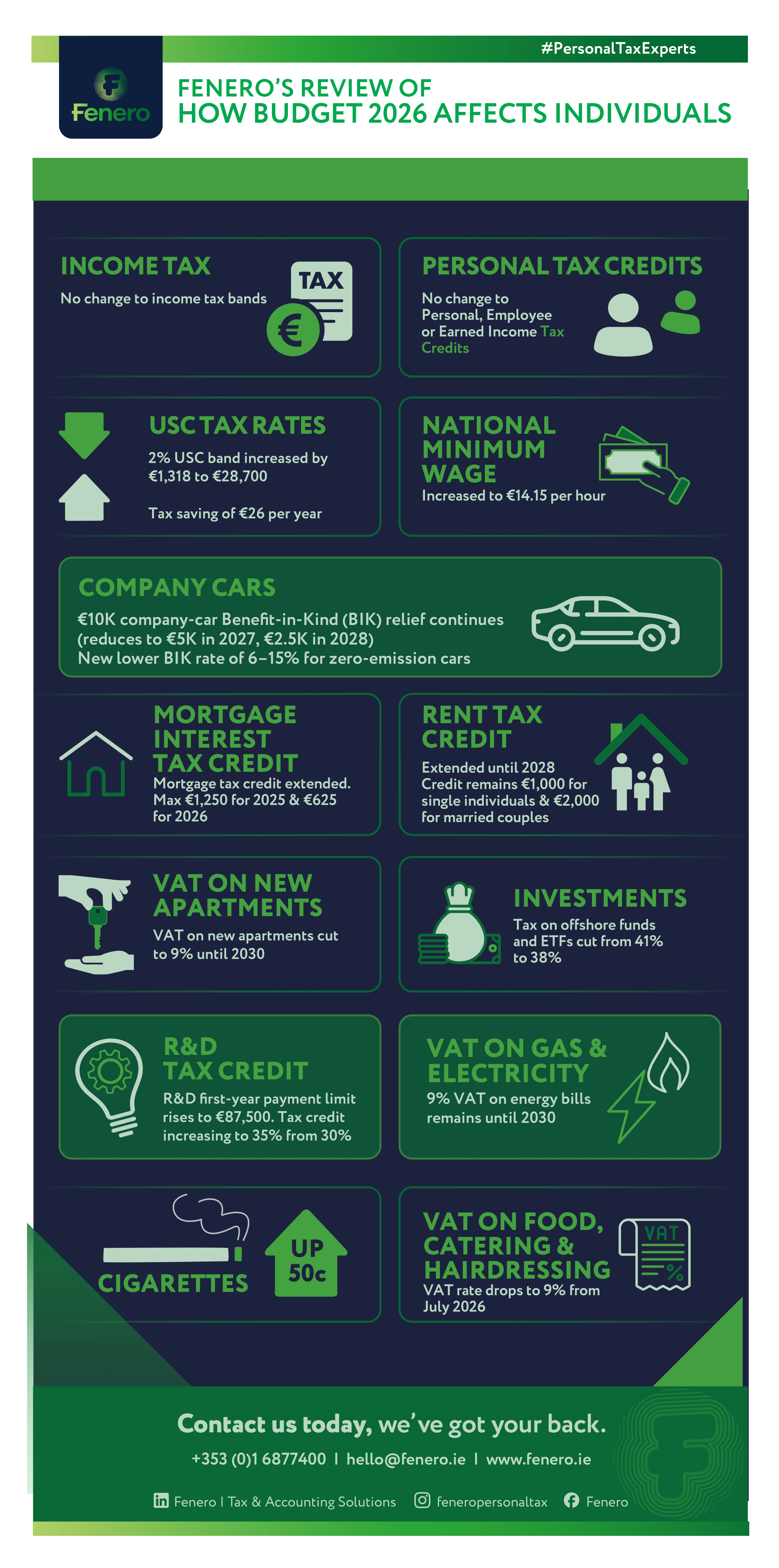

Personal Tax

- No change to the 20 % income-tax rate band or personal tax credits.

- The 2 % USC band increases by €1,318 to €28,700, giving a saving of roughly €26 a year.

This ensures full-time workers on the minimum wage remain outside higher USC rates. - The national minimum wage rises by 65 cents, to €14.15 per hour from 1 January 2026.

While these are welcome, there’s no broad tax relief to offset inflation; so planning and efficient structuring remain key to improving your net position.

Investments

- The tax rate on Irish and equivalent offshore investment funds, including ETFs, reduces from 41 % to 38 %.

A small but positive change for savers and investors.

Rent Tax Credit

- Extended to 31 December 2028.

- Value remains €1,000 for individuals and €2,000 for jointly assessed couples.

- Parents paying rent for student children can continue to claim this credit.

Mortgage Interest Relief

- Extended for 2025 and 2026.

- Capped at €1,250 for 2025 and €625 for 2026.

- Applies to qualifying homeowners with a mortgage balance between €80,000 – €500,000 on 31 December 2022.

Energy Costs

- No new energy credits, but the 9 % VAT rate on gas and electricity is extended to 31 December 2030.

Apartments and Regeneration

- VAT on new apartments reduced from 13.5 % to 9 % from 8 October 2025 to 31 December 2030 to boost supply.

- The Living City Initiative is extended to 2030, now including Athlone, Dundalk, Drogheda, Letterkenny and Sligo, and covering residential properties built before 1975.

Landlords and Property Owners

- The retrofitting deduction is extended to 31 December 2028.

Relief can now be claimed in the year the expenditure occurs, and for up to three properties (previously two). - Landowners under the Residential Zoned Land Tax have another opportunity in 2026 to apply for rezoning exemptions.

Entrepreneurs and Investors

- R&D Tax Credit rate rises from 30 % to 35 %, with the first-year payment threshold increased to €87,500 to support cashflow for smaller firms.

- Entrepreneur Relief: lifetime CGT limit increases from €1 million to €1.5 million for disposals from 1 January 2026 – potentially worth up to €165,000 in tax savings for qualifying business owners.

Indirect Taxes

- From 1 July 2026, VAT for food, catering and hairdressing drops from 13.5 % to 9 %.

- Tobacco: excise duty on a pack of 20 cigarettes increases by 50 c (with pro-rata increases on other tobacco products).

Climate and Vehicles

- Carbon Tax rises from €63.50 to €71 per tonne from 8 October 2025 for auto fuels and 1 May 2026 for all others.

- VRT relief for electric vehicles extended to 31 December 2026.

- Benefit-in-Kind (BIK) relief on company cars and vans continues but tapers:

- €10,000 in 2026

- €5,000 in 2027

- €2,500 in 2028

A new zero-emission BIK category (6 – 15 %) will apply based on business mileage. This is good news for anyone considering purchasing an electric vehicle through their company.

- Accelerated Capital Allowances for energy-efficient equipment extended to 2030.

- The €400 Income Tax exemption for household micro-generation of electricity extended to 31 December 2028.

The Bottom Line

Budget 2026 keeps Ireland’s finances steady but offers little relief for day-to-day cost pressures. For most individuals and contractors, the gains are modest, and the real difference will come from smart planning rather than new policy.

Stay informed – we’re here to help

At Fenero, we make sense of how each Budget affects you and your finances.

If you’d like personal advice or help maximising your take-home income in 2026, email us at hello@fenero.ie or call +35316877400.

We look forward to helping you stay compliant, confident, and planning to be better off.