.

.

The Cycling Boom

Bicycle shops in Ireland have reported record sales during COVID-19 and the UK has reported a similar experience.

Much of these COVID-19 sales were likely related to leisure cycling during lockdown, but as more people are returning to the workplace now that restrictions are lifting, cycling may increase when it comes to commuting, particularly as an alternative to public transport.

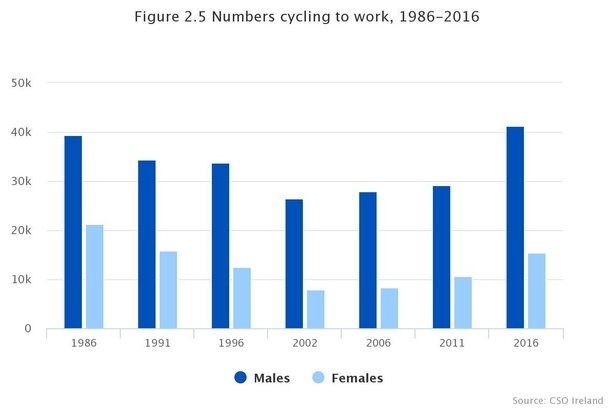

Cycling to work has already been increasing significantly in popularity in Ireland in recent years. According to the Central Statistics Office, the most recent census showed that the number of people cycling to work jumped by 43% between 2011 and 2016 to 56,837.

.

July Stimulus Package boost for the Bike-To-Work Tax Scheme

The government are hoping to further encourage the increasing popularity of cycling to work by increasing the value of savings available under the Bike-to-Work Tax Scheme. Announcements in the “July Stimulus Package” included increasing the costs allowable under the Bike-to-Work Tax Scheme by a hefty 50% for electric bicycles and 25% for all other bicycles.

Can Contractors Avail of the Bike-To-Work Tax Scheme?

Yes, the good news is that the tax scheme is also available for contractors..

What savings are available under the scheme?

Using the Bike to Work Tax Scheme, you can purchase a bicycle or electric bicycle, and safety equipment, and obtain tax relief of up to 52% on the cost, subject to an upper value of the purchase price.

The upper limits on expenditure allowable for tax relief under the scheme are:

- €1,500 in respect of electric bicycles

- €1,250 in respect of other bicycles

(both of which increased from €1,000 in the “July Stimulus Package”).

On top of this, savings are made on Employers PRSI tax charges which are relevant to umbrella contractors set up under an Employee/PAYE (non-director) option. If the cost of your bike and equipment exceeds the relevant upper limits of €1,250 or €1,500, no tax relief is available on the balance above the limits.

What are the rules of the scheme?

To be eligible to avail of the scheme you must:

- Use the bike primarily for the purposes of travelling to and from work or between places of work;

- Spend no more than €1,250 on your bicycle and safety equipment at one time, or €1,500 in the case of purchasing an electric bicycle.

You cannot avail of the scheme if:

- You have already availed of it in the last 5 years, even if you did not maximise the full upper limit values previously.

Tax relief is only available when the purchase is arranged through your umbrella company, so it is essential to liaise with your umbrella company service provider for assistance with making payment for your bicycle. If you operate through your own personal limited company, you should ensure that the invoice from the bicycle shop is made out to your company and that is paid by a bank transfer from your company bank account or via a company credit card.

Expert Solutions and Market Leading Customer Experience for Contractors

Fenero support businesses, recruitment agencies and thousands of contractors with tax and payment management solutions for contracting. If you need friendly, expert financial advice and support for any aspect of contracting, contact us on hello@fenero.ie or 01-6877400.

.