With an overall package of €11 billion, Budget 2023 has been framed as a “Cost of Living” budget. What does that mean in practical terms?

Of the €11 billion Budget 2023 package:

- €1.1 billion relates to income tax measures

- €5.8 billion relates to expenditure measures

- €4.1 billion relates to a “winter package”

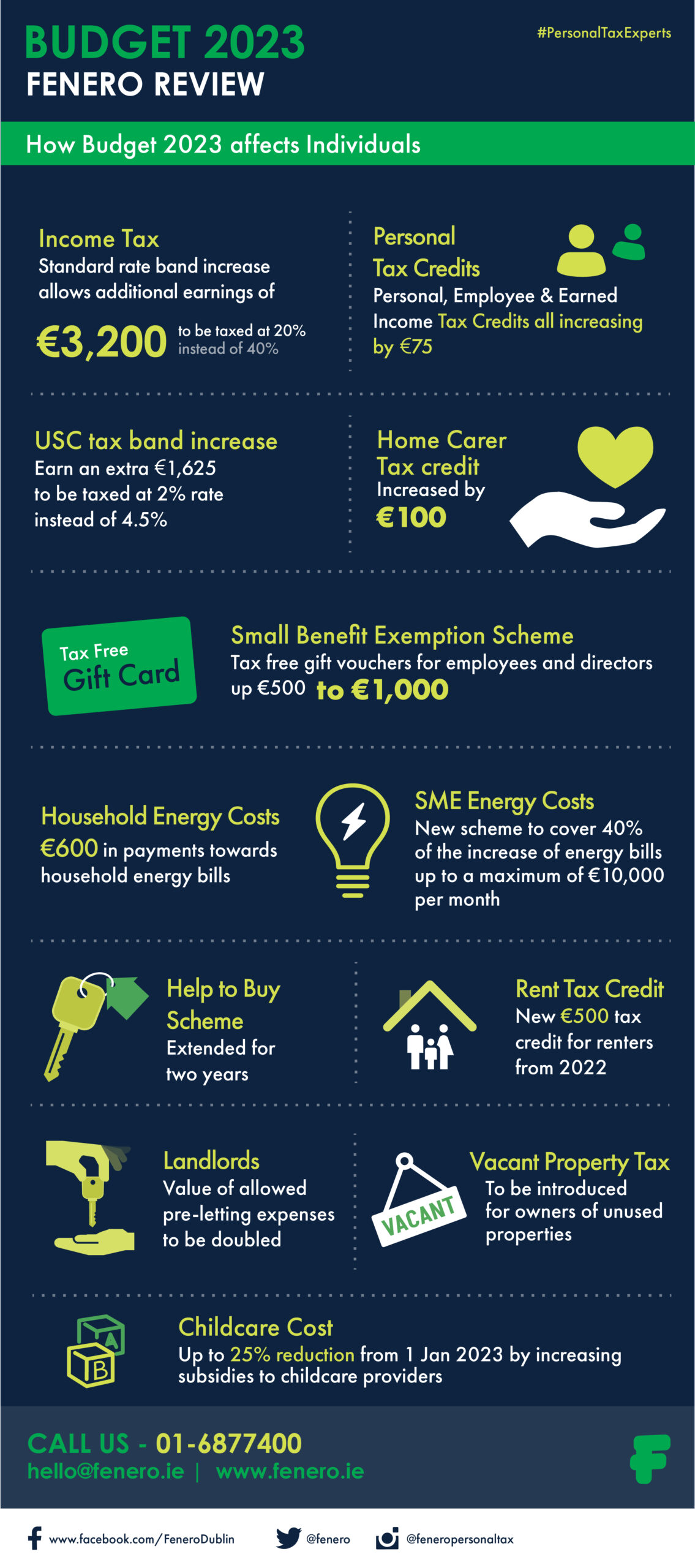

In our infographic and article below, we’ve summarised some key takeaways, including how the changes in tax rate bands and tax credits can add up to €831 of tax savings.

Key takeaways

For a full written overview of the key takeaways, scroll down or click here.

“In drafting Budget 2023 Government has a responsibility to strike a delicate balance between helping with the cost of living pressures but, on the other hand, not making them worse by adding fuel to the inflationary fire. Despite the challenges facing our country, I am confident that we will be able to continue to support individuals, families and businesses.This confidence is based on the fact that we approach this test from a position of strength. A record number of people at work, with a budget surplus, reserving money for the needs of the future, inside – not outside – efforts to reform global corporate tax and intervening to help homes and businesses with rising costs.”

Paschal Donohoe, Minister for Finance, 27th September 2022

PERSONAL TAX

There are a number of changes to personal taxation on income announced in the budget. Changes in the 20% tax rate bands, personal and employee or earned income tax credits, and the small change to the USC rate band, can add up to €831 of tax savings. The maximum amount of €831 will apply to those who pay tax at the higher 40% rate.

Tax Credits

There is a €75 tax credit increase for the Personal Tax Credit, Employee Tax Credit and Earned Income Tax Credit, meaning these tax credits will become worth €1,775 in 2023.

20% Tax Rate Band

The 20% income tax rate band (known as the “standard rate band”) is increasing by €3,200. This will allow you to earn up to €3,200 more which is taxed at the lower 20% tax rate instead of the 40% tax rate.

USC

The 2% USC rate band will be increased slightly, allowing you to earn an additional €1,625 at the 2% rate before moving into the 4.5% rate.

Home Carer Tax Credit

The Home Carer Tax Credit is increasing by €100 and will be worth a maximum of €1,700 in 2023.

SMALL BENEFITS EXEMPTION SCHEME

The value of the highly popular small benefits exemption scheme is doubling with immediate effect for 2022 from €500 to €1,000.

To explain, under the Small Benefits Exemption Scheme company directors and employees can receive a non-cash bonus of €1,000 (previously €500) on a completely tax-free basis each year. As the payment must be in a non-cash form, the most common way to avail of this scheme is by purchasing gift vouchers. The increase will not wait until 2023 to take effect and will be available for 2022.

RENTERS, HOMEOWNERS & LANDLORDS

New Tax Credit for Renters

A new tax credit of €500 for renters is being introduced for 2022 and the years onwards.

Help-To-Buy Scheme

The Help-to-Buy scheme will be extended for a further two years to 31 December 2024.

Landlord Pre-Letting Expenses

In a bid to encourage landlords in the residential rental sector to return empty properties to the market as quickly as possible, Budget 2023 is enhancing the amount of eligible pre-letting expenses for landlords to €10,000. Additionally, the vacancy period is being halved to only 6 months.

New “Vacant Property Tax”

Budget 2023 also introduces a “Vacant Property Tax” to tax unoccupied properties. This tax will be charged at a rate equal to three times the property’s existing basic Local Property Tax rate. The tax will apply to residential properties which are occupied for less than 30 days in a 12-month period, with a number of exemptions available where a property may be unoccupied for a genuine reason.

INDIRECT TAXES

Cigarettes

Efforts to discourage smokers continue, with excise duty on cigarettes rising again – up 50 cent on a packet of 20 cigarettes, with a pro-rata increase from other tobacco products.

VAT rate for Hospitality Sector

The reduced VAT rate of 9% for the tourism and hospitality sectors will revert back to its previous rate of 13.5% from 1 March 2023.

Newspapers

VAT on newspapers will reduce from 9% to zero from 1 January 2023 which the Minister said was “in line with the Government’s commitment to support an independent press and the Future of Media Commission’s recommendation on this matter.”

ENERGY COSTS – HOUSEHOLDS AND SMEs

Households

Support for households with vastly increased energy costs is coming in the form of a total of €600, spread over three payments of €200.

SMEs

One of the new support schemes for energy costs for businesses over the winter is targeted at SMEs. This will be backdated to September 2022 and is expected to run to at least February 2023. This scheme will be known as the Temporary Business Energy Support Scheme. If an SME business has experienced more than a 50% increase in energy costs, the scheme will cover 40% of the increase in electricity and gas costs, up to a maximum of €10,000 per month per business. It will be open to businesses carrying a “Case 1” trade and provided they are tax compliant.

COST OF LIVING WINTER PACKAGE

A substantial amount of the overall Budget 2023 is directed at measures to support people and businesses with cost of living challenges during the coming winter. In addition to the energy cost measures mentioned above, Budget 2023 provides a range of one-off support measures. Included in the many announced today are:

- A double Child Benefit payment will be made to all qualifying households, worth €140 per child in addition to the normal monthly payment.

- A once-off reduction in the Student Contribution of €1,000 for eligible students in the 2022-2023 education year, and a once-off double monthly payment for those in receipt of the SUSI maintenance grant.

STAY INFORMED – WE’RE HERE TO HELP

For any initiatives where timelines are unclear at this time or further details are to follow from government in the coming days and weeks, follow Fenero on LinkedIn to be kept up to date with relevant and important news.

Multi-Award Winning Tax Experts In All Things Contracting!

Fenero are multi-award winning friendly tax specialists and experts in all things contracting. We are straight-talking tax and financial experts, with a single-minded mission to deliver market leading customer experience; fast, friendly, informative service and great value fees.

Reasons why Contractors choose Fenero include:

- 24/7 Access to myFenero online platform

- Dedicated Account Manager

- Google Reviews rating 4.9/5

- Winners: 2022 Payroll Team of the Year

- Winners: 2021 & 2019 Customer Experience Impact in Professional Services

- Winners: 2020 Tax Team of the Year

- Winners: 2019 Accountancy Practice of the Year

- Great value fees

- Comprehensive insurance coverage

- Multiple money-back service level guarantees

- Contractor Wellbeing Programme – free medical and counselling services and discounted health insurance plans

- Financial and Tax Planning Support

- 13 years + experience

- Process €200m+ contractor payments annually

We are proud winners of Payroll Team of the Year 2022, Tax Team of the Year 2020 and Accountancy Practice of the Year 2019 in the Irish Accountancy Awards as well as the CX Impact in Professional Services Awards in the 2021 and 2019 Irish Customer Experience Impact Awards! So talk to the best in the industry for all the expert tax and financial advice you need to maximise the financial benefits of contracting!

For more information on getting started in contracting or to get a free illustrative calculation showing how much you can earn as a professional contractor, drop a line to the friendly, expert crew in our Solutions Team.